US$ Euro Yen

North America

Caribbean

Central America

South America

Western Europe

Eastern Europe

Russia

Former USSR

Middle East

North Africa

West Africa

East Africa

Southern Africa

South Asia

Pacific Rim

Commodities

Multinational

December 1, 2025 (see December 17 update below). Next update: January 2, 2026. Visit Search to look at past issues of World Currency Observer (brochure edition).

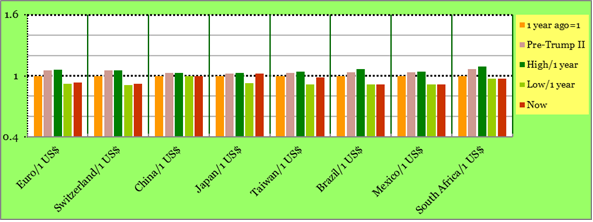

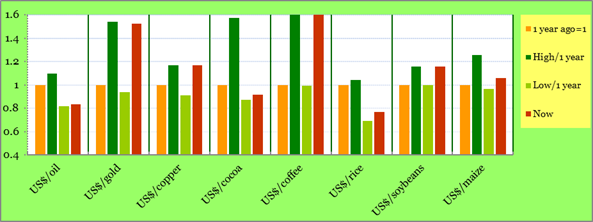

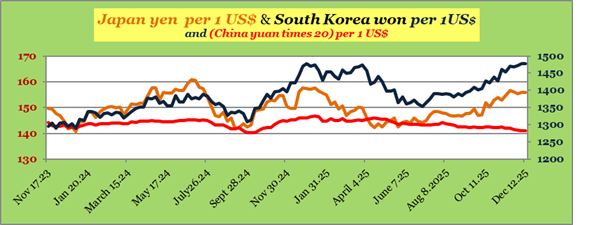

The United States Federal Reserve has previously indicated that December 1 2025 is the end of the 3 1/2 year strategy of "shrinking" holdings on the Fed balance sheet (mainly US treasury bonds), which has been part of “quantitative tightening’, which implies there may now be downward pressure on longer term interest rates, complimenting the recent movement to lower short-term United States interest rates, and which may continue when the next short-term interest rate announcement is made on December 9/10. Looking at exchange rate movements around the world: the Mexico peso was up by 1.5% against the US$ in November 2025, and is up by nearly 7.5% since this time last year. The Canada dollar moved up on the last day of the month after a stronger-than-expected GDP report, and finished November up slightly against the US$. The Dominican Republic peso was up by 2.25% against the US$ in November, and down by 4.25% since this time last year. South America currencies were almost all stronger against the US$ in November. The Argentina peso finished the month at 1443/1US$, just under the 1450 threshold which is at the top of the central bank foreign exchange band. The Euro showed a 0.5% strengthening against the United States dollar in November 2025. The Swiss franc had some ups and downs on the month (during which it reached a framework agreement with the US regarding some very high tariffs), and the franc finished November with no net change against the US$. The United Kingdom pound was up 1% on the month against the US$. The Albania lek was down by 3.5% against the US$ in November (down around 4% against the Euro), but is up 5.5% against the US$ since this time last year. For yet another month, all currencies in the countries of the former USSR were up against the US$ in November, with the largest movement being a 2.25% upward movement of the Russia ruble against the US$. In the Middle East, there was a 2% rise in the Egypt pound in November. A broad range of Africa currencies moved up slightly against the US$ in November. Among the Africa currencies that weakened against the US$ were: the Uganda new shilling (down 4%), the Mauritius rupee (down 2.5%), and the Ghana cedi. Japan, in a month with a new prime minister bringing expectation of looser budget policy and perhaps lower interest rates, had the largest downward movement among Asia currencies in November 2025, with a net downward movement of 1.5% (after taking into account a strengthening against the US$ in the last week of the month). Also weakening against the US$ was the Taiwan dollar, down 2% on the month, but up by 1.75% since this time last year. After a number of up-and-down movements, the India rupee finished November down 1% against the US dollar. The price of gold prices was up slightly in November 2025 (slightly below the peak it reached recently), and oil prices were down on the month.

In Malawi (in southern Africa, population 22 million), which has had a fixed official exchange rate regime since November 2023 (the current official rate of the Malawi kwacha was fixed at 1751/1$US in April 2024 after a devaluation from 1700 , and the current parallel rate is at 1940/1960, a 10% premium over the official rate), discussion continues regarding the appropriate approach to a “foreign exchange shortage”, with the Malawi Minister of Finance reportedly suggesting that, in the past, the government recognizes that straight devaluations of the kwacha have not fixed those situations when they occur, and that it favours a broader approach, such as modifying foreign exchange-related public expenditures (which have contributed to what are considered to be high levels of debt). The perceived need for devaluation is driven by an inflation rate of around 30%, which is in turn strongly influenced by food price increases, a problem around the world – and, in the case of Malawi, there was drought last year (which had an impact on exports of commodities such as tobacco). An additional factor: the overall cuts in Official Development Assistance, to Malawi and many countries and organizations, which were announced by several countries in 2024, and are projected to continue for several years.

In Quebec (population 9 million), the Parti Québécois, the main opposition party which has governed the province twice in the last fifty years and is aiming to do so again after the forthcoming Quebec election, has always had the democratic separation of Quebec from Canada as its ultimate goal and, as such, has just released a 10 year timetable and process it would follow to approach the question of whether and when it would issue its own currency, or adopt the United States dollar, or continue using the Canada dollar after independence from Canada was declared following a referendum. In the past, the PQ has suggested that an independent Quebec would continue to use the Canada dollar. While the process just outlined by the PQ to adopt the currency appears to be intense, thorough and gradual (it would, it is projected, take at least thirty years), the recent release make the likelihood of things happening more likely, as it includes a preliminary list of the pros and cons of using/not-using each of the Canada dollar, the United States dollar, and an as-of-yet unnamed Quebec currency. With regard to staying with the Canada dollar (perhaps as part of a monetary union): the pros mentioned for Quebec would include none of the transition costs associated with establishing its own currency; the negatives cited include not enough autonomy for an independent Quebec (which would be in a minority situation), and limited ability to provide lender of last resort support, and other services, for a Quebec financial sector. With regard to adopting the United States dollar: the pros cited include the advantages of having Quebec trade and finance with the rest of the world with the use of the most acceptable international currency; the negatives mentioned include very little autonomy for Quebec, such as, perhaps, absolutely no influence on monetary policy (the list mentions the experience of the significant number of countries said to have discovered this after adopting the US$). As to a Quebec currency: the pros cited include the development of a more comprehensive Quebec financial sector, perhaps including the re-emergence of an in-Quebec stock exchange (diluted in 1999 as part of a specialization deal with other Canadian capital market sectors); the negatives mentioned include the often difficult process it would be for Quebec to establish the infrastructure of having its own currency, as many other countries have shown.

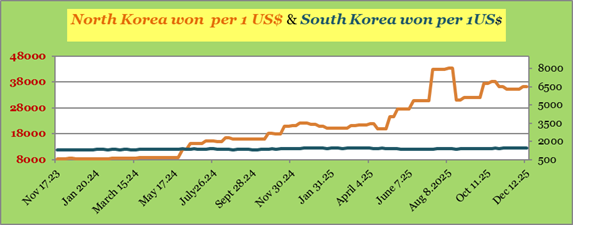

A few notes on recent developments with regard to the currencies of North Korea (population 26 million, with a land boundary with China) and South Korea (population 52 million, whose coast is adjacent to Japan). The trajectory of the South Korea won against the US$ (which is classified as floating against the US$, and is presently at around 1500 per 1$US) roughly follows that of the Japan yen, including the recent downward movement of the yen noted above in earlier parts of WCO. As to the North Korea won, the trajectory of the in-country quotes for the parallel rate of the won against the US$ (currently at around 40000 per 1$US) is generally consistent with that of agricultural benchmarks, such as the in-North Korea won price of a kilogram of rice in the major cities in the country (currently at around 20,000 NK won per kilogram) – North Korea is said to produce perhaps around 90% of the rice needed for its own consumption, with the remainder imported from countries such as China. There has been a general weakening in the North Korea won over the last year-and-a-half, which was widely remarked upon in November 2024 as appearing to be linked to the growing involvement and support by North Korea (weapons and personnel) for the Russia “special military operation” in Ukraine, which deepened in May 2024 with the signing of a formal agreement (“…full sympathy and support for all measures taken by the Russian government to eliminate the root cause of the Ukraine conflict and to safeguard [Russian] sovereignty, security interests, and territorial integrity.”, and similar Russian support for North Korea.) The NK won reached a low point in the summer of 2025, and has generally strengthened since then, though it is nowhere nearly as strong as the 8900 level it was at in early 2024. (Next month: the Venezuela bolivar soberano.)

(World Currency Observer will next be updated on January 2, 2026. Visit Search to look at past issues of World Currency Observer (brochure edition). For permission-to-quote enquiries, e-mail World Currency Observer at WCO@briargreen.com.)